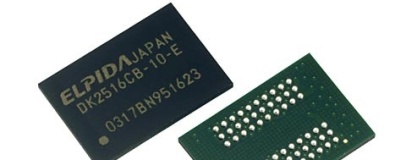

DRAM giant Elpida has confirmed its financial struggles, announcing that it has applied for bankruptcy protection with the Tokyo District Court.

The memory maker is facing mounting debts: according to figures released by the company in a press conference earlier this week, the total is in the region of ¥448 billion or around £3.5 billion.

Following the announcement, Elpida's stock plunged 97 per cent on the Tokyo Stock Exchange from ¥247 to just ¥7 per share. Analyst fear the company could fall still further: 'Elpida's shares are worth zero after the delisting announcement,' investor Mitsushige Akino told Businessweek following the drop.

The massive drop comes as rumours spread of a takeover by another memory maker. With Elpida's shares trading so low, the company is ripe for acquisition. Its high debt, however, may be too much for its rivals to take on while the memory market is still recovering from a pricing slump that saw DRAM wholesale value drop by 85 per cent.

Despite investor panic, the company has vowed to battle on. Asian technology news site Tech-On reports that Elpida will not be replacing its management team as a result of the anti-bankruptcy reorganisation. Whether that's a sound move or not only time will tell.

Should Elpida's reorganisation fail, it will represent one of the biggest bankruptcies to hit Tokyo in years. It would also leave a major gap in the DRAM market - one which competitors like Samsung and Hynix would look to fill. In 2011, Elipda held around 18 per cent of the global DRAM market, with Hynix holding 25 per cent and Samsung 39 per cent.

With DRAM prices expected to rise as stock is depleted and the PC market recovers from its slump following the recent hard drive shortage, it could be a bad time for Elpida to go under. If the company can hold on for the next few months, it may find its fortunes turning around.

The memory maker is facing mounting debts: according to figures released by the company in a press conference earlier this week, the total is in the region of ¥448 billion or around £3.5 billion.

Following the announcement, Elpida's stock plunged 97 per cent on the Tokyo Stock Exchange from ¥247 to just ¥7 per share. Analyst fear the company could fall still further: 'Elpida's shares are worth zero after the delisting announcement,' investor Mitsushige Akino told Businessweek following the drop.

The massive drop comes as rumours spread of a takeover by another memory maker. With Elpida's shares trading so low, the company is ripe for acquisition. Its high debt, however, may be too much for its rivals to take on while the memory market is still recovering from a pricing slump that saw DRAM wholesale value drop by 85 per cent.

Despite investor panic, the company has vowed to battle on. Asian technology news site Tech-On reports that Elpida will not be replacing its management team as a result of the anti-bankruptcy reorganisation. Whether that's a sound move or not only time will tell.

Should Elpida's reorganisation fail, it will represent one of the biggest bankruptcies to hit Tokyo in years. It would also leave a major gap in the DRAM market - one which competitors like Samsung and Hynix would look to fill. In 2011, Elipda held around 18 per cent of the global DRAM market, with Hynix holding 25 per cent and Samsung 39 per cent.

With DRAM prices expected to rise as stock is depleted and the PC market recovers from its slump following the recent hard drive shortage, it could be a bad time for Elpida to go under. If the company can hold on for the next few months, it may find its fortunes turning around.

MSI MPG Velox 100R Chassis Review

October 14 2021 | 15:04

Want to comment? Please log in.