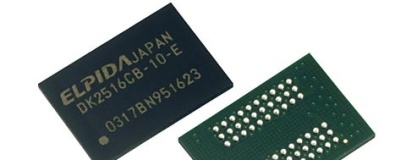

Memory specialist Micron has confirmed its intention to buy ailing competitor Elpida for $2.5 billion as a means of boosting its share of the DRAM market.

Despite working on some exciting new products - including a ReRAM prototype module which promises to bridge the gap between volatile DRAM and non-volatile NAND flash - Elpida's been having a tough time of it lately. Back in February the company filed for bankruptcy protection as it faced mounting debts reaching ¥448 billion (around £3.5 billion). Following the announcement, Elpida's stock plummeted 97 per cent on the Tokyo Stock Exchange, and many thought the company was done.

Micron's announcement not only saves the bulk of Elpida, but also means a leapfrogging in market share: despite its financial problems, Elpida commands a 12.8 per cent share of the DRAM market - a position helped by an agreement with Apple to provide chips for its various products including the popular iPhone 4 and iPad family - ahead of Micron's 12.2 per cent. As a result, the post-purchase Micron will enjoy a 24.8 per cent market share - moving it from fourth place to second place, with only semiconductor giant Samsung ahead.

Additionally, Micron will be able to take advantage of Elpida's production facilities to increase volumes and hopefully retain its newly-enlarged share of the market.

With DRAM prices beginning to return to sanity after a slump which saw the wholesale value of modules drop by 85 per cent, Micron could have timed its acquisition perfectly - after all, how often is it a smaller company gets to wholly acquire a larger competitor?

Despite working on some exciting new products - including a ReRAM prototype module which promises to bridge the gap between volatile DRAM and non-volatile NAND flash - Elpida's been having a tough time of it lately. Back in February the company filed for bankruptcy protection as it faced mounting debts reaching ¥448 billion (around £3.5 billion). Following the announcement, Elpida's stock plummeted 97 per cent on the Tokyo Stock Exchange, and many thought the company was done.

Micron's announcement not only saves the bulk of Elpida, but also means a leapfrogging in market share: despite its financial problems, Elpida commands a 12.8 per cent share of the DRAM market - a position helped by an agreement with Apple to provide chips for its various products including the popular iPhone 4 and iPad family - ahead of Micron's 12.2 per cent. As a result, the post-purchase Micron will enjoy a 24.8 per cent market share - moving it from fourth place to second place, with only semiconductor giant Samsung ahead.

Additionally, Micron will be able to take advantage of Elpida's production facilities to increase volumes and hopefully retain its newly-enlarged share of the market.

With DRAM prices beginning to return to sanity after a slump which saw the wholesale value of modules drop by 85 per cent, Micron could have timed its acquisition perfectly - after all, how often is it a smaller company gets to wholly acquire a larger competitor?

MSI MPG Velox 100R Chassis Review

October 14 2021 | 15:04

Want to comment? Please log in.