Intel has confirmed plans to buy Altera, a field-programmable gate array (FPGA) specialist, in a deal valued at $16.7 billion as it seeks to further extend its lead in the data centre and break new ground in embedded markets.

Intel has long been a majority market holder in desktops, laptops, and the data centre, but you don't get into that position by being complacent. The company has been working for several years on extending the capabilities of its processors, from the Xeon Phi family of many-core Pentium-based co-processors through to experiments with using its tri-gate transistor technology in Altera's field-programmable gate arrays (FPGAs) in February 2013.

Now, the company has confirmed last month's rumour and announced that it is to acquire Altera lock, stock and barrel for a whopping $16.7 billion (£11 billion) - far more than the $10 billion previously estimated.

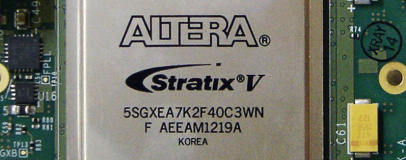

Altera is one of the biggest FPGA companies around, trading blows with fellow giant Xilinx to produce chips which can be modified on-the-fly to various tasks. As well as finding uses in small-scale manufacturing where building an application-specific integrated circuit (ASIC) would be cost-prohibitive, smaller FPGAs are frequently found in embedded projects to provide the 'glue' that ties various parts of the system together. FPGAs are also used to accelerate various tasks in the data centre, from hashing through to communications functions.

Intel has confirmed that the deal values Altera at $54 per share, a more than 10 per cent premium on the company's stock price, for a total of $16.7 billion. Intel has confirmed that it intends to integrate Altera's FPGA technology into future product lines, likely starting with the Xeon range of data centre processors. The news comes less than a month after the company announced it was to partner with eASIC Corporation to build security and big-data acceleration hardware into its Xeon products - boasting of performance 'up to two times that of a field programmable gate array.'

Intel has long been a majority market holder in desktops, laptops, and the data centre, but you don't get into that position by being complacent. The company has been working for several years on extending the capabilities of its processors, from the Xeon Phi family of many-core Pentium-based co-processors through to experiments with using its tri-gate transistor technology in Altera's field-programmable gate arrays (FPGAs) in February 2013.

Now, the company has confirmed last month's rumour and announced that it is to acquire Altera lock, stock and barrel for a whopping $16.7 billion (£11 billion) - far more than the $10 billion previously estimated.

Altera is one of the biggest FPGA companies around, trading blows with fellow giant Xilinx to produce chips which can be modified on-the-fly to various tasks. As well as finding uses in small-scale manufacturing where building an application-specific integrated circuit (ASIC) would be cost-prohibitive, smaller FPGAs are frequently found in embedded projects to provide the 'glue' that ties various parts of the system together. FPGAs are also used to accelerate various tasks in the data centre, from hashing through to communications functions.

Intel has confirmed that the deal values Altera at $54 per share, a more than 10 per cent premium on the company's stock price, for a total of $16.7 billion. Intel has confirmed that it intends to integrate Altera's FPGA technology into future product lines, likely starting with the Xeon range of data centre processors. The news comes less than a month after the company announced it was to partner with eASIC Corporation to build security and big-data acceleration hardware into its Xeon products - boasting of performance 'up to two times that of a field programmable gate array.'

MSI MPG Velox 100R Chassis Review

October 14 2021 | 15:04

Want to comment? Please log in.