"No tax breaks will push UK developers abroad"

December 10, 2009 | 11:10

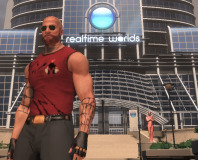

Companies: #realtime-worlds

Realtime Worlds, the developer of upcoming All Points Bulletin and one of the UK's most notable games studios, believes that the refusal of a tax break for the games industry yesterday may push companies to move abroad.

The comments come in reply to Chancellor Alistair Darling, who today fulfilled expectations by failing to provide tax breaks for the games industry despite strong lobbying from trade groups such as ELSPA and TIGA.

"If it is right to provide tax relief for the UK film industry then it is also right to provide tax relief for the UK videogames sector," said TIGA's Richard Wilson yesterday, highlighting that the games industry in the UK was larger and more profitable than the UK film business and that it was important to encourage expansion of the medium within the UK.

In reply to the refusal of a tax break, Realtime World's studio manager Colin MacDonald told Develop that it was a massive disappointment and that studios may choose to expand to other countries which provide more favourable conditions, like the US or Canada.

“No-one can dispute that the industry is growing. There are a lot of jobs still to be created, as well as IP and value – and today’s decision means the majority of that isn’t going to happen in the UK," he said.

“We’ve created 300 jobs since setting up in 2002. If we were to create another 300, we’d have to look overseas – and I doubt that discussion would fall favourably on the UK. I think that goes for across UK development now.

“When you look at Canada, without the tax break here, it’s a tough argument for the UK to win.

Let us know your thoughts in the forums.

The comments come in reply to Chancellor Alistair Darling, who today fulfilled expectations by failing to provide tax breaks for the games industry despite strong lobbying from trade groups such as ELSPA and TIGA.

"If it is right to provide tax relief for the UK film industry then it is also right to provide tax relief for the UK videogames sector," said TIGA's Richard Wilson yesterday, highlighting that the games industry in the UK was larger and more profitable than the UK film business and that it was important to encourage expansion of the medium within the UK.

In reply to the refusal of a tax break, Realtime World's studio manager Colin MacDonald told Develop that it was a massive disappointment and that studios may choose to expand to other countries which provide more favourable conditions, like the US or Canada.

“No-one can dispute that the industry is growing. There are a lot of jobs still to be created, as well as IP and value – and today’s decision means the majority of that isn’t going to happen in the UK," he said.

“We’ve created 300 jobs since setting up in 2002. If we were to create another 300, we’d have to look overseas – and I doubt that discussion would fall favourably on the UK. I think that goes for across UK development now.

“When you look at Canada, without the tax break here, it’s a tough argument for the UK to win.

Let us know your thoughts in the forums.

MSI MPG Velox 100R Chassis Review

October 14 2021 | 15:04

Want to comment? Please log in.