AMD has released its latest quarterly earnings report, and despite seeing growth a combination of a struggling graphics processor business and lowered outlook for the fourth quarter of the year has seen its stock price drop nearly 27 percent in post- and pre-market trading.

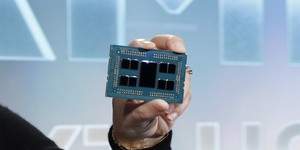

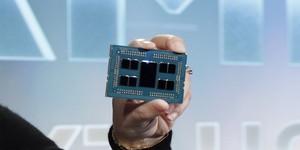

In its report for the third quarter of its 2018 financial year, AMD had a number of reasons to celebrate: Its gross profit margin has risen three percentage points quarter-on-quarter and four percentage points year-on-year to 40 percent, outpacing a two percentage point growth in its operating expenses against revenue year-on-year, and its operating income is up from $61 million in the same period last year to $150 million this year. '“We delivered our fifth straight quarter of year-over-year revenue and net income growth driven largely by the accelerated adoption of our Ryzen, Epyc, and data centre graphics products,' explains Dr. Lisa Su, AMD president and chief executive, of the results. 'Client and server processor sales increased significantly although graphics channel sales were lower in the quarter. Looking forward, we believe we are well positioned for further market share gains as we continue making significant progress towards our long-term financial targets.'

Investors, though, seem unimpressed. While the company showed a 12 percent year-on-year growth for its combined computing and graphics segment, driven by higher average selling price on CPU parts, its GPU sales have suffered from the downtrend in purchases for cryptocurrency mining plus a lack of high-end parts and new product launches leading to a decrease in graphics average selling price. It's the company's outlook for the next three months, though, that has investors most concerned: While it forecasts an eight percent year-on-year growth to $1.45 billion in revenue, that's considerably lower than the $1.6 billion analysts had previously pegged for the company.

The result: A serious shrinkage of AMD's share price, with post-close and pre-open trading combining to see the company's shares plummet 26.94 percent to $22.79 a share. For investors who had got on board relatively recently, that's bad news; for long-term investors, though, the drop has done little to wipe out gains from the company's 52-week low of $9.04 per share.

The company has confirmed, too, that it doesn't expect things to change in the graphics processor market before the end of the year: Its forecast for the next quarter predicts growth from mainstream Ryzen, server Epyc, and 'data centre GPU processor' sales, but says nothing of consumer-oriented graphics products.

MSI MPG Velox 100R Chassis Review

October 14 2021 | 15:04

Want to comment? Please log in.