AMD surprised investors in its latest earnings call with the announcement of a joint venture with a Chinese technology investment firm worth $293 million and promise of a 15 per cent revenue growth in the coming quarter - enough to spike its share price a whopping 52 per cent.

AMD has been in financial difficulty for some time. Aside from brief moments of profitability, its earnings reports have long been awash in a sea of red with losses the company cannot continue to make year-on-year and expect to survive. Investor confidence has been low, the company's share price has been sinking, and it has already flogged off its real estate holdings to generate some short-term cash in exchange for a long-term drain on the balance sheet.

In its most recent quarterly report, though, there were signs that things are brightening. At first, it's hard to see: revenue of $832 million for the quarter represents a drop of 19 per cent year-on-year, with the result being a $68 million loss. Year-on-year, though, that's a lot better than the $137 million from the first quarter of its last financial year - and there were details that suggested some profitability could be on the cards.

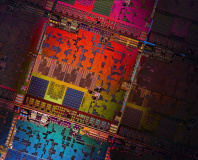

The biggest of these was the announcement of a joint venture with China's Tianjin Haiguang Advanced Technology Investment Co. (THATIC), a division of the Chinese Academy of Sciences, to develop system-on-chip processors based on AMD's x86 cores for the server market. The deal is purely for x86 and SoC IP, AMD confirmed during its earnings call, with no GPU or ARM IP making the leap. Regardless, AMD has high hopes: it expects to earn $293 million from the deal, assuming it hits the contractual milestones outlined as part of the agreement, plus ongoing royalties based on sales of the parts produced.

The news was enough to chivvy investors into movement: Following the announcement, AMD's share price rose 52.29 per cent, putting it at its highest level since September 2014 even accounting for a 4.51 per cent dip in after-hours trading as those without the stomach for long-term risk divested to make a quick return.

AMD has been in financial difficulty for some time. Aside from brief moments of profitability, its earnings reports have long been awash in a sea of red with losses the company cannot continue to make year-on-year and expect to survive. Investor confidence has been low, the company's share price has been sinking, and it has already flogged off its real estate holdings to generate some short-term cash in exchange for a long-term drain on the balance sheet.

In its most recent quarterly report, though, there were signs that things are brightening. At first, it's hard to see: revenue of $832 million for the quarter represents a drop of 19 per cent year-on-year, with the result being a $68 million loss. Year-on-year, though, that's a lot better than the $137 million from the first quarter of its last financial year - and there were details that suggested some profitability could be on the cards.

The biggest of these was the announcement of a joint venture with China's Tianjin Haiguang Advanced Technology Investment Co. (THATIC), a division of the Chinese Academy of Sciences, to develop system-on-chip processors based on AMD's x86 cores for the server market. The deal is purely for x86 and SoC IP, AMD confirmed during its earnings call, with no GPU or ARM IP making the leap. Regardless, AMD has high hopes: it expects to earn $293 million from the deal, assuming it hits the contractual milestones outlined as part of the agreement, plus ongoing royalties based on sales of the parts produced.

The news was enough to chivvy investors into movement: Following the announcement, AMD's share price rose 52.29 per cent, putting it at its highest level since September 2014 even accounting for a 4.51 per cent dip in after-hours trading as those without the stomach for long-term risk divested to make a quick return.

MSI MPG Velox 100R Chassis Review

October 14 2021 | 15:04

Want to comment? Please log in.