Intel has found a way to spend some of its recent record $12.9 billion profits: buying the InfiniBand business of networking specialist QLogic.

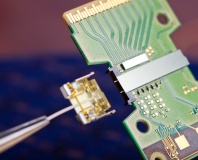

A high-performance switched fabric communications technology frequently found gracing the server rooms of supercomputing houses and other high-performance computing (HPC) specialists, InfiniBand is a niche yet impressive product: available in a variety of different flavours, top-end InfiniBand connections range in performance from 2Gb/s for 1x SDR InfiniBand to an eye-watering 300Gb/s for 12x EDR InfiniBand.

Designed to provide point-to-point serial connectivity between supercomputing nodes, the high throughput couples with extremely low latency to help shuffle data between nodes without harming the overall performance of the system.

In short, it's not a technology you'll be seeing on the desktop any time soon. But it does form an important part of Intel's exascale computing vision - to produce HPC systems with 100 times the performance currently possible at a power draw only double that of today's systems - originally outlined by Intel's vice president and general manager of the Data Centre Group Kirk Skaugen at the International Supercomputing Conference last year.

'At the conference, Intel unveiled a bold vision to redefine HPC performance and break the exascale barrier by 2018,' explained Skaugen in a statement regarding the deal. 'The technology and expertise from QLogic provides inportant assets to provide the scalable system fabric needed to execute on this vision. Adding QLogic's InfiniBand product line to our networking portfolio will bring increased options and exceptional value to our datacentre customers.'

'The sale of these InfiniBand assets will benefit our shareholders by enabling us to provide better focus and greater investment in growth opportunities for the data center with our converged networking, enterprise Ethernet, and storage area networking products,' added QLogic's chief executive and president Simon Biddiscombe. 'After the sale, our cash position will be further strengthened and we expect the impact on earnings per share to be neutral.'

When Biddiscombe says that his company's cash position will be strengthened, he really means it: Intel has confirmed that it's shelling out a whopping $125 million in cash to acquire the assets in a deal which will also see 'a significant number' of QLogic's InfiniBand-specific employees moving to Intel.

Do you think Intel is spending its money wisely, or - given the disparity in earnings between the consumer processor and data centre business units - would it do better shoring up its graphics capabilities instead? Share your thoughts over in the forums.

A high-performance switched fabric communications technology frequently found gracing the server rooms of supercomputing houses and other high-performance computing (HPC) specialists, InfiniBand is a niche yet impressive product: available in a variety of different flavours, top-end InfiniBand connections range in performance from 2Gb/s for 1x SDR InfiniBand to an eye-watering 300Gb/s for 12x EDR InfiniBand.

Designed to provide point-to-point serial connectivity between supercomputing nodes, the high throughput couples with extremely low latency to help shuffle data between nodes without harming the overall performance of the system.

In short, it's not a technology you'll be seeing on the desktop any time soon. But it does form an important part of Intel's exascale computing vision - to produce HPC systems with 100 times the performance currently possible at a power draw only double that of today's systems - originally outlined by Intel's vice president and general manager of the Data Centre Group Kirk Skaugen at the International Supercomputing Conference last year.

'At the conference, Intel unveiled a bold vision to redefine HPC performance and break the exascale barrier by 2018,' explained Skaugen in a statement regarding the deal. 'The technology and expertise from QLogic provides inportant assets to provide the scalable system fabric needed to execute on this vision. Adding QLogic's InfiniBand product line to our networking portfolio will bring increased options and exceptional value to our datacentre customers.'

'The sale of these InfiniBand assets will benefit our shareholders by enabling us to provide better focus and greater investment in growth opportunities for the data center with our converged networking, enterprise Ethernet, and storage area networking products,' added QLogic's chief executive and president Simon Biddiscombe. 'After the sale, our cash position will be further strengthened and we expect the impact on earnings per share to be neutral.'

When Biddiscombe says that his company's cash position will be strengthened, he really means it: Intel has confirmed that it's shelling out a whopping $125 million in cash to acquire the assets in a deal which will also see 'a significant number' of QLogic's InfiniBand-specific employees moving to Intel.

Do you think Intel is spending its money wisely, or - given the disparity in earnings between the consumer processor and data centre business units - would it do better shoring up its graphics capabilities instead? Share your thoughts over in the forums.

MSI MPG Velox 100R Chassis Review

October 14 2021 | 15:04

Want to comment? Please log in.