Intel sells NAND SSD facilities to Micron

March 2, 2012 | 11:17

Companies: #intel #intel-micron-flash-technologies #micron

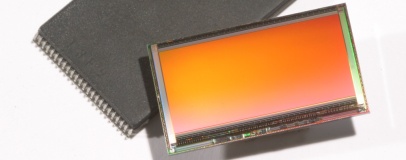

Intel has indicated that it's looking to get out of the NAND flash manufacturing business, selling its stake in two wafer factories to partner Micron for the book value of $600 million.

Intel and Micron have long partnered on NAND flash production, under the joint company Intel Micron Flash Technologies (IMFT.) Previously, the companies had enjoyed a half-and-half split, but the announcement of Intel's withdrawal from manufacturing leaves Micron holding a far bigger slice of the pie.

Under the terms of the revised agreement, Intel is to sell its shares in two wafer factories to Micron for $600 million. Half of that will be provided to Intel in the form of cold hard cash, while the remaining $300 million is to be left in Micron's hands as an advance deposit on Intel's future NAND flash purchases.

It's clear to see where Intel is going here: it's looking to reduce its exposure in the NAND flash market while still ensuring it has an adequate supply of cutting-edge chips for its enterprise and consumer grade solid-state drive (SSD) products.

Micron, meanwhile, gets a near-guarantee of $300 million of future business as well as sole control of the Intel Micron Flash Singapore and Intel Micron Flash Technologies US assets. The jointly-owned manufacturing plant in Utah, meanwhile, will remain as-is with minimal changes to its ongoing production of 20nm-based NAND flash products.

'Micron's joint venture NAND development efforts with Intel are a model of innovation, productivity and effectiveness,' claimed Micron's chief executive Mark Durcan. 'With IM Flash and its associated programs, our companies have become leaders in the NAND flash arena. These new agreements build on that success.'

'The Intel-Micron partnership has created industry-leading NAND flash memory technology and developed a robust global manufacturing network. The new NAND flash supply agreement with Micron gives Intel better flexibility to meet growing demand for SSDs and other products,' claimed Robert Crooke, general manager of the Non-Volatile Memory Solutions Group at Intel.

Missing from Intel's announcement on the matter, of course, is an explanation of why it's reducing its holdings in the joint venture. With some promising new storage technologies on the horizon, could this be an indication that Intel believes NAND's days are numbered?

Intel and Micron have long partnered on NAND flash production, under the joint company Intel Micron Flash Technologies (IMFT.) Previously, the companies had enjoyed a half-and-half split, but the announcement of Intel's withdrawal from manufacturing leaves Micron holding a far bigger slice of the pie.

Under the terms of the revised agreement, Intel is to sell its shares in two wafer factories to Micron for $600 million. Half of that will be provided to Intel in the form of cold hard cash, while the remaining $300 million is to be left in Micron's hands as an advance deposit on Intel's future NAND flash purchases.

It's clear to see where Intel is going here: it's looking to reduce its exposure in the NAND flash market while still ensuring it has an adequate supply of cutting-edge chips for its enterprise and consumer grade solid-state drive (SSD) products.

Micron, meanwhile, gets a near-guarantee of $300 million of future business as well as sole control of the Intel Micron Flash Singapore and Intel Micron Flash Technologies US assets. The jointly-owned manufacturing plant in Utah, meanwhile, will remain as-is with minimal changes to its ongoing production of 20nm-based NAND flash products.

'Micron's joint venture NAND development efforts with Intel are a model of innovation, productivity and effectiveness,' claimed Micron's chief executive Mark Durcan. 'With IM Flash and its associated programs, our companies have become leaders in the NAND flash arena. These new agreements build on that success.'

'The Intel-Micron partnership has created industry-leading NAND flash memory technology and developed a robust global manufacturing network. The new NAND flash supply agreement with Micron gives Intel better flexibility to meet growing demand for SSDs and other products,' claimed Robert Crooke, general manager of the Non-Volatile Memory Solutions Group at Intel.

Missing from Intel's announcement on the matter, of course, is an explanation of why it's reducing its holdings in the joint venture. With some promising new storage technologies on the horizon, could this be an indication that Intel believes NAND's days are numbered?

MSI MPG Velox 100R Chassis Review

October 14 2021 | 15:04

Want to comment? Please log in.