Western Digital continues to block Toshiba Memory deal

October 11, 2017 | 11:41

Companies: #apple #bain-capital #dell #kingston #sandisk #seagate #sk-hynix #toshiba #toshiba-memory-corporation #western-digital

Western Digital has again reiterated its plan to block Toshiba's sale of its semiconductor subsidiary to a Bain Capital-led consortium, despite the ink now being dry on the deal.

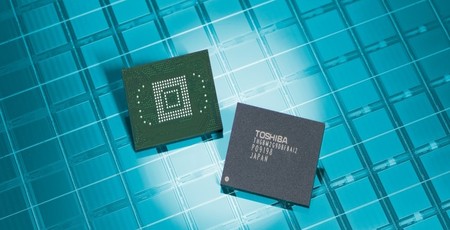

To offset losses made by a disastrous attempt at breaking into the US nuclear energy market, Toshiba announced plans to spin off its semiconductor division, minus its imaging sensor business, into a separate company dubbed Toshiba Memory Corporation. To bring in much-needed cash, a chunk of said business was to be sold to outside investors with SK Hynix and Micron among the early bidders. While Western Digital was itself interested in making a deal, the company would cry foul when Toshiba went with an investment group which includes rivals SK Hynix, Seagate, Kingston, as well as major WD customers Apple and Dell - and the two have been arguing the toss ever since.

When Toshiba announced the signing of a £26.4 billion deal for its TMC subsidiary, it looked like the sale might be progressing - but Western Digital is continuing to put up a fight with claims that Toshiba's flash memory joint venture with Western Digital subsidiary SanDisk, which has brought us many-layer 3D flash implementations, means the sale simply can't go ahead.

In a Q&A document released late last night (PDF warning), Western Digital reiterated its claim that the Toshiba-SanDisk joint venture gives Western Digital a complete veto over any sales or investment - a power it intends to exercise. The company also claimed that Toshiba's recently-announced investment in expanding its Fab 6, the primary manufacturing facility for the joint venture's products, represents an attempt in 'trying to exclude SanDisk from Fab 6 to coerce SanDisk into waiving its consent rights.'

As with its previous proclamations, Western Digital is sticking to its guns with regards to the veto power granted to it through the joint venture agreement. 'The JV agreements are clear that Toshiba cannot transfer any of its interests in the JVs – for example, its equity in the JVs, its managerial and control rights, its contractual rights under the JV agreements, and its rights to receive output from Yokkaichi – without SanDisk’s consent. As a first order of business in the arbitration, SanDisk will seek interim injunctive relief to prevent Toshiba from transferring without SanDisk’s consent any of Toshiba’s JV interests, whether in whole or in part, through a sale of TMC or otherwise, until the arbitration process reaches its final disposition. From there, Western Digital intends to seek a permanent injunction.'

The company has also poured water on claims from Bain Capital, which is leading the TMC investment deal, that it has offered to settle with Western Digital. 'No,' the Q&A document clearly states. 'They [Bain Capital] have not contacted Western Digital. We do not have any current discussions with Bain.'

Neither Toshiba nor Bain Capital have responded to Western Digital's latest announcement.

MSI MPG Velox 100R Chassis Review

October 14 2021 | 15:04

Want to comment? Please log in.