Samsung, Micron, SK Hynix hit with price-fixing suit

April 30, 2018 | 11:05

Companies: #hagens-berman #micron #samsung #sk-hynix

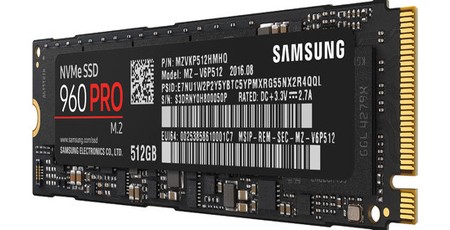

Samsung, Micron, and SK Hynix, in their roles as the three largest manufacturers of volatile and non-volatile memory in the world, have found themselves the target of a class-action suit alleging that the recent rise in prices is the result not of increased demand and constrained supply but of direct price-fixing collusion between the companies.

Anyone who has priced up a PC of late will know that memory, both for RAM and for storage, has become extremely expensive. According to the manufacturers, like SK Hynix, this is a simple matter of demand exceeding supply, and until additional manufacturing capacity can be brought on line - with all major semiconductor firms in the process of opening new fabrication facilities, expanding existing fabrication facilities, or both at present - or yields on existing production lines improved, there will be little relief.

US law firm Hagens Berman, however, disagrees. In a suit filed late Friday, the company accuses Samsung, Micron, and SK Hynix - the three largest memory manufacturers in the world, and the majority share of the overall market - of price-fixing. 'An investigation has revealed that a group of the largest electronics manufacturers that produce dynamic random-access memory (DRAM) may have agreed to collectively raise the price of memory used in mobile phones and computers from 2016-2017, illegally inflating the price paid by consumers,' the company explains in its statement. 'This collusion, if proven, would violate federal antitrust laws, and attorneys believe those who purchased an affected phone or computer deserve repayment.

'The investigation involves Micron, Samsung and Hynix, and points to a scheme between the manufacturers. According to attorneys, the DRAM manufacturers agreed to limit the supply of DRAM, a critical component of phones and computers – therefore driving up prices for this widely used memory. If true, this resulted in an illegal price-fixing scheme that led to consumers overpaying for electronics. DRAM saw a 47 percent jump in price-per-bit in 2017, the largest jump in 30 years.'

The company has filed its suit with a demand for class-action status, and is actively seeking class members via its website with a view to obtaining compensation for anyone who has purchased a smartphone or computer between 2016 and 2017.

Hagens Berman has form on this front: In 2002 the company filed a similar price-fixing class-action suit against dynamic memory manufacturers including Micron, Crucial, Infineon, SK Hynix, Samsung, Elpida, NEC, and others. and in 2006 settled the case for $300 million in damages.

None of the companies named in company's latest suit, which can be read in full on the official website (PDF warning), have issued a statement on the matter.

MSI MPG Velox 100R Chassis Review

October 14 2021 | 15:04

Want to comment? Please log in.